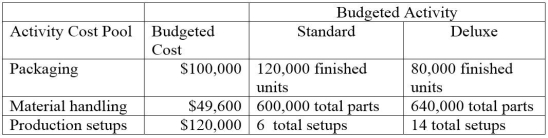

Bark Mode, Incorporated produces and distributes two types of security systems, Standard and Deluxe. Budgeted cost and activity for each of its three activity cost pools are shown below.

The company plans to produce and sell 120,000 standard units and 80,000 deluxe units.  a. Compute the approximate overhead cost per unit of standard under activity-based costing.

a. Compute the approximate overhead cost per unit of standard under activity-based costing.

b. Compute the approximate overhead cost per unit of deluxe under activity-based costing.

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products or job orders, calculated at the start of the fiscal year based on estimated costs and activities.

Labor-Hour

A measure of the amount of work or labor time required or used to produce a good or service.

Variable Overhead Efficiency Variance

The difference between the actual variable overhead incurred and the standard cost of variable overhead that should have been incurred based on the efficiency of operations.

Favorable

An accounting term referring to actual results being better than projected or budgeted figures, often used in the context of variances.

Q85: The FIFO method of computing equivalent units

Q86: A company produces heating elements that go

Q94: Actual factory overhead incurred in a job

Q97: Explain cost flows for the plantwide overhead

Q161: Andrews Corporation uses the weighted-average method of

Q164: If Department R uses $60,000 of direct

Q168: Assume a company sells a given product

Q176: Enterprise risk management (ERM) includes the systems

Q199: Under a job order costing system, individual

Q208: Cost accounting systems used by manufacturing companies