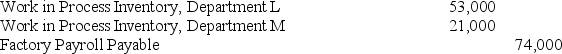

If Department L uses $53,000 of direct labor and Department M uses $21,000 of direct labor, the following journal entry would be recorded using a process costing system:

Definitions:

Difficult to Quantify

This term describes items or factors that are hard to measure or express in numerical terms due to their subjective or complex nature.

Annual After-Tax Cash Flow

The amount of money a company or individual has left after all income taxes are paid, considered over a yearly period.

Present Value

The current value of a future sum of money or stream of cash flows, taking into account a specific rate of interest.

After-Tax Cash Flow

The amount of cash a company generates after accounting for all taxes, an important measure for assessing financial performance and investment potential.

Q19: Sparks Company produces and distributes two types

Q32: What is the basic principle underlying activity-based

Q89: The premise of ABC is that it

Q90: The journal entry to record the purchase

Q91: A fixed cost:<br>A) Requires the future outlay

Q125: A company uses a process costing system

Q164: Job order production systems would be appropriate

Q181: Management's pricing and cost decisions for a

Q203: A time ticket is a source document

Q223: A system of accounting in which costs