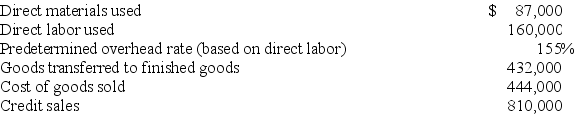

Dazzle, Inc. produces beads for jewelry making use. The following information summarizes production operations and sales activities for June. The journal entry to record June sales is:

Definitions:

Excise Tax

A specific type of tax levied on particular goods, services, or transactions, often included in the price of items such as gasoline, alcohol, and tobacco.

Taxable Income

The portion of an individual's or a corporation's income that is subject to taxes according to governmental regulations.

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income, indicating the percentage of any additional income that will be paid in taxes.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxes by the government, after all deductions and exemptions.

Q8: Tarnish Industries uses departmental overhead rates and

Q59: Comet Company accumulated the following account

Q95: Factory overhead is often collected and summarized

Q101: The concept of total quality management focuses

Q105: The following data is available for Donaldson

Q128: In process costing, the cost object is

Q138: A hybrid costing system would be most

Q155: Oxford Company uses a job order costing

Q156: Pitt Enterprises manufactures jeans. All materials are

Q216: A direct cost is a cost that