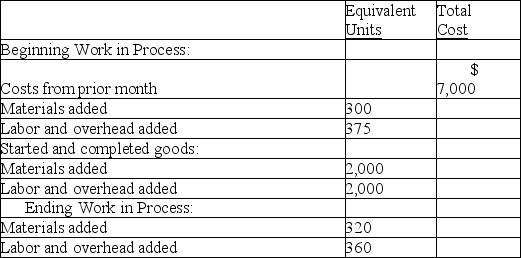

Refer to the following information about the Shaping Department of the Minnesota Factory for the month of August. Minnesota Factory uses the FIFO method of inventory costing.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00.Prepare a cost reconciliation for the month of August.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00.Prepare a cost reconciliation for the month of August.

Definitions:

Overapplied

A situation where the allocated overhead costs in accounting exceed the actual overhead costs incurred.

Underapplied

In cost accounting, it describes a situation where the allocated overhead costs are less than the actual overhead costs incurred.

Manufacturing Overhead

All the extra expenses tied to production except for direct materials and workforce costs.

Work in Process

The goods in production that are not yet completed, representing a stage between raw materials and finished goods.

Q1: The sales commission incurred based on units

Q16: Under a just-in-time manufacturing system, large quantities

Q122: Varigon Co. produces and sells three products-Household,

Q126: The following items for Neptune Company

Q140: If Department C uses $10,000 of direct

Q193: The main difference between the cost of

Q194: Blast Rocket Company manufactures candy-coated popcorn treats

Q205: A company's total expected overhead costs and

Q215: Crinkle Cut Clothes Company manufactures two products

Q227: The cost of units transferred from Work