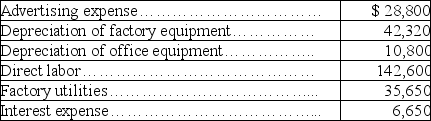

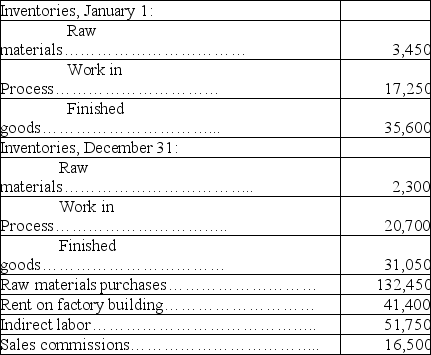

The following calendar year information about the Tchulahota Corporation is available on December 31:

The company applies overhead on the basis of 125% of direct labor costs. Calculate the amount of over- or underapplied overhead.

The company applies overhead on the basis of 125% of direct labor costs. Calculate the amount of over- or underapplied overhead.

Definitions:

Merger Approval

The authorization granted by a regulatory body or shareholders for two or more companies to consolidate into one entity.

Block Merger

A strategy in business consolidation where two or more companies with similar operations merge to create a larger entity.

Target Corporation

A large retail corporation headquartered in the United States, known for offering a wide range of goods including clothing, electronics, and groceries.

Shareholders

Individuals or entities that own shares in a corporation, giving them ownership interests and possibly rights to dividends and voting in corporate matters.

Q13: Period costs for a manufacturing company, such

Q45: Morris Company applies overhead based on direct

Q94: Compute Tasty's departmental overhead rate for the

Q117: The second step in accounting for production

Q130: Using the information below, calculate gross

Q147: Luker Corporation uses a process costing system.

Q158: A production department's output for the most

Q213: Last year, Gordon Company sold 20,000 units

Q234: Craigmont Company's direct materials costs are $3,000,000,

Q244: A schedule of cost of goods manufactured