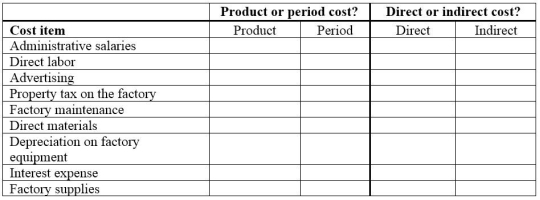

For each item shown below, classify it as a product cost or a period cost, by placing an X in the appropriate column. For each item that is a product cost, also indicate whether it is a direct cost or an indirect cost with respect to a unit of finished product.

Definitions:

Federal Tax Revenue

The income collected by the federal government from taxes, including income taxes, payroll taxes, and corporate taxes, used to fund public services and obligations.

Tax Rates

The rate at which a person or business is required to pay taxes to the authorities.

K-12 Public Education

The publicly funded education system in the United States that covers kindergarten through 12th grade.

Property Tax

A levy on property that the owner is required to pay, typically based on the value of the property, used to fund local government and public services.

Q1: Because there is always a chance that

Q15: Explain and briefly distinguish between simple random

Q17: If actual overhead incurred during a period

Q19: Proportions and percentages,ratios and rates are all

Q50: According to the study presented in the

Q63: Minstrel Manufacturing uses a job order costing

Q128: The cost of partially completed products is

Q166: In a job order costing system, raw

Q167: Describe the flow of labor in a

Q199: Just-in-time manufacturing (JIT) is a system that