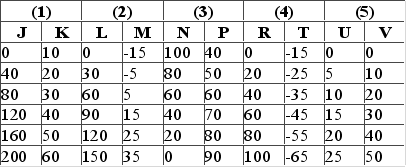

Answer the question on the basis of the following five data sets, wherein it is assumed that the variable shown on the left is the independent variable and the one on the right is the dependent variable. Assume in graphing these data that the independent variable is shown on the horizontal axis and the dependent variable on the vertical axis.  Refer to the data sets. The equation for data set 3 is

Refer to the data sets. The equation for data set 3 is

Definitions:

Risk-Free Asset Return

Risk-Free Asset Return denotes the amount of return expected from an investment with no risk of financial loss, typically associated with government bonds.

Standard Deviation

A measure of the amount of variability or spread in a set of data points; in finance, it's often used to quantify the risk associated with a particular investment.

Risk Premium

The additional return expected by an investor for taking on a higher level of risk, compared to a risk-free investment.

Nominal Interest Rate

The interest rate in terms of nominal (not adjusted for purchasing power) dollars.

Q23: Which of the following terms implies the

Q42: A characteristic of the market system is<br>A)

Q43: A physician must fit individuals with the

Q45: (Last Word) According to economist Donald Boudreaux,<br>A)

Q51: Studies of masculinity reveal that straight boys

Q70: _ is the general category of putting

Q97: "The role of government in the economy

Q164: If the production possibilities curve is a

Q223: The invisible hand promotes society's interests because<br>A)

Q238: The slope of the typical production possibilities