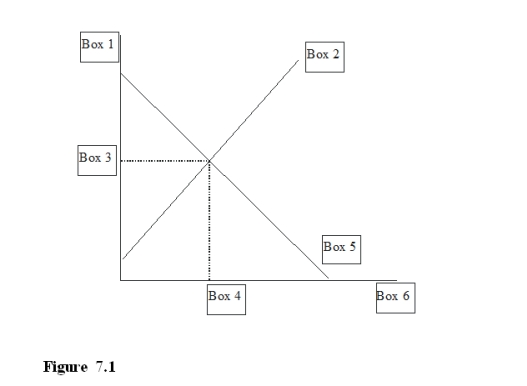

-Assuming that Figure 7.1 is a market for money that can be borrowed or saved, Box 6 is

Definitions:

Richest Households

The segment of the population that possesses the highest net worth or income compared to all other households.

Federal Personal Income Tax

Federal Personal Income Tax is a tax levied by the federal government on the annual income of individuals.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of tax paid on any additional dollar of income.

Excise Taxes

Taxes levied on specific goods or services, such as gasoline or alcohol, often imposed to discourage their use or generate revenue.

Q1: An example of discretionary fiscal policy would

Q5: A monetary aggregate is<br>A)coin.<br>B)paper currency.<br>C)coin and paper

Q7: Federal spending as a percentage of GDP

Q34: An increase in government spending will cause<br>A)AD

Q35: If the Federal Reserve has indirect influence

Q42: An increase in the discount rate would

Q51: Which of the following programs is on-budget?<br>A)The

Q68: Any event that creates a "crisis in

Q135: Which of the following can make the

Q187: The Federal Reserve is most concerned with<br>A)the