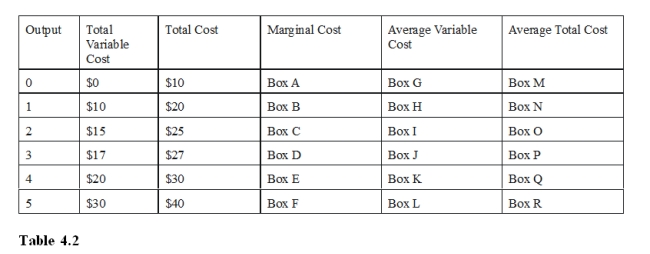

-Refer to Table 4.2, Box O should be filled with

Definitions:

Moral Rules

Guidelines for behavior that are considered right or ethical according to a particular philosophy, society, or religion.

Legally Sanctioned

Actions or behaviors that are permitted or approved by law, often implying they have been officially authorized or ratified.

Impeachment

The process by which Congress brings charges against and tries a high-level government official for misconduct.

Supreme Court

The highest judicial court in a country or state, which has the ultimate authority to adjudicate in legal disputes and interpret the law.

Q31: If the market price for a good

Q52: Which of the following is not a

Q69: Which of the following algebraic expressions is

Q78: Suppose you are deciding whether or not

Q104: Economists know that consumers and producers are

Q108: In Figure 1.2, which labeled point indicates

Q123: When attempting to correct cases of "market

Q170: If the price of a good increases

Q182: On the Heritage Foundation's scale of "Economic

Q191: The quintessential example of substitute goods would