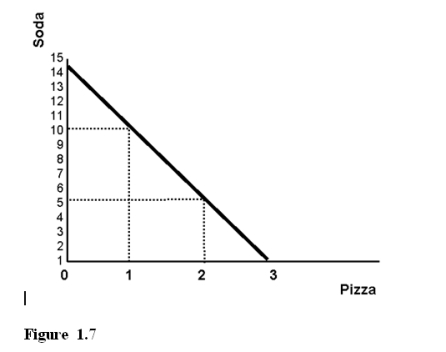

-Using Figure 1.7 you can tell that

Definitions:

Absorption Costing

This accounting technique combines all costs associated with manufacturing, such as materials directly used, labor directly applied, and all categories of overhead, fixed or variable, in determining a product’s cost.

Unit Product Cost

The total cost (both direct and indirect) assigned to a single unit of product.

Unit Product Cost

The total cost (both direct and indirect) associated with producing one unit of a product, used in pricing and profitability analysis.

Absorption Costing

A method of accounting that incorporates all costs related to manufacturing, including direct materials, direct labor, as well as both variable and fixed overheads, into the product's price.

Q6: On a supply and demand diagram<br>A)the horizontal

Q8: Of the three oxides SiO<sub>2</sub>, MgO, and

Q12: The value to the consumer is based

Q13: In the coordination compound K<sub>2</sub>[Co(en)Cl<sub>4</sub>], the coordination

Q16: Which of the following polymers is formed

Q22: Economic incentives can come from<br>A)markets.<br>B)government programs.<br>C)taxes.<br>D)all of

Q33: Which is the product of the reaction

Q43: What are the two raw materials used

Q43: Specialized growth is typically the result of

Q87: If two goods are considered complements and