Use the following to answer question(s) : Tax Incidence

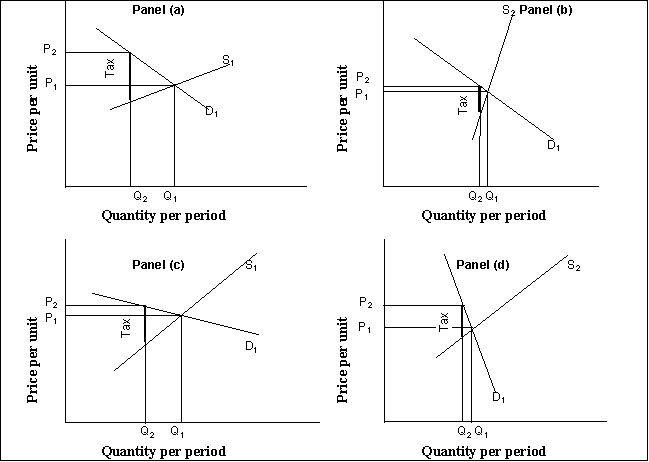

-(Exhibit: Tax Incidence) All other things unchanged, when a good or service is characterized by a relatively elastic supply, as shown in Panel _______ , the greater share of the burden of an excise tax imposed on it (shown by the tax wedge in each panel) is borne by _______.

Definitions:

Allowance

A fixed amount of money allotted on a regular basis, typically for a specific purpose.

Individual Choices

Decisions made by individuals based on their preferences and constraints.

Economic Incentives

Factors, often financial or material, that motivate individuals or businesses to pursue certain actions or behaviors.

Exploiting Opportunities

The act of taking strategic actions to capitalize on favorable conditions or circumstances to achieve desired outcomes.

Q2: Consumer protection laws are based on:<br>A) the

Q5: If a tariff is imposed on imported

Q5: The World Trade Organization was created in

Q30: Which of the following statements is true?<br>A)

Q62: If the purpose of taxation is to

Q72: Suppose that the United States imposes a

Q90: If the executives of the U.S.silicon-chip industry

Q102: (Exhibit: Production Possibilities for Machinery and Petroleum)

Q123: In general, if the level of the

Q141: (Exhibit: Production Possibilities in Alphaland and Omegaland)