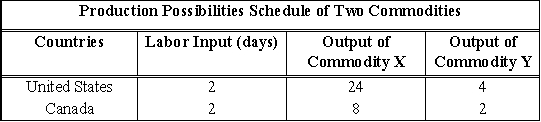

Use the following to answer question(s) : Production Possibilities Schedule for Two Commodities

-(Exhibit: Production Possibilities Schedule for Two Commodities) Assuming constant costs in the neighborhood of their current levels of production, the exhibit shows the number of units of commodity X each country would have to forgo to produce the additional units of commodity Y indicated.Further assume that the only input is labor and that it remains fully employed.We see from the table that the United States:

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, also known as un-diversifiable risk or market risk.

Low-beta Stocks

Stocks with a beta coefficient lower than one, indicating they are less volatile than the market and tend to offer more stable returns.

High-beta Stocks

Stocks that are more volatile than the market average, possessing a beta value greater than 1, indicating they have a higher risk and potential return.

Systematic Risk

A type of risk that affects all securities in a market or market segment, unable to be lessened through diversification.

Q10: A firm buying factors of production in

Q44: A regulatory approach that states precisely what

Q44: Laws that prohibit union-shop rules are called:<br>A)

Q47: Unions have often tended to be vigorous

Q59: A merger that involves firms at different

Q68: (Exhibit: The Production of Tires and Radios)

Q74: (Exhibit: Income Distribution) Curve B shows that

Q112: There are actual benefits resulting indirectly from

Q155: (Exhibit: Heartland and Soulland) If trade now

Q175: (Exhibit: Production Possibilities for Machinery and Petroleum)