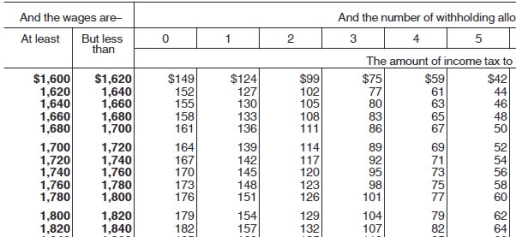

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

Definitions:

Negligence

Failure to take reasonable care to avoid causing injury or loss to another person, resulting in legal liability for any resulting damages.

Utility Costs

Expenses associated with services such as electricity, water, gas, and sewage required for the operation of a home or business.

Lease Modification

Changes made to the terms of a lease agreement, often involving negotiations between the lessee and lessor.

Bound Agreement

A legally binding contract or arrangement between parties.

Q14: Jesse is a part-time nonexempt employee who

Q23: McHale Enterprises has the following incomplete

Q29: A debit always decreases the balance of

Q46: Last year,Teresa's Fashions earned $2.03 per share

Q70: Compensatory time is only Federally mandated for

Q87: Which one of these is correct?<br>A)Depreciation has

Q88: An increase in which one of the

Q89: If ending inventories are overstated,net income is

Q98: DC purchases a tract of land with

Q107: Goods held on consignment from a supplier