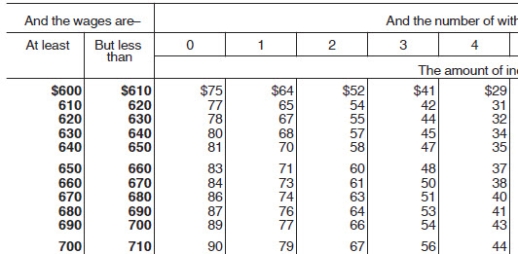

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table) ?

Definitions:

Fallopian Tubes

Two tubes that connect the ovaries to the uterus, playing a crucial role in the female reproductive system by facilitating the passage of eggs.

Ovulate

The phase in a woman's menstrual cycle where an egg is released from the ovary, making fertilization possible.

Men's Fertility

The natural capability of men to produce offspring through sexual activity or assisted reproductive technologies.

Spacing Children

The practice of planning and extending the interval between the birth of children in a family to manage resources and health better.

Q7: DC bought Assets A,B,and C for

Q12: The tax rate that determines the amount

Q16: In a general partnership,each partner is personally

Q18: Red's Waterworks is a semiweekly depositor.One month

Q26: Besides payroll information,the payroll register contains _.<br>A)

Q26: Which of the following is not an

Q31: The common stock of Sweet Treats has

Q36: Which most closely identifies why it is

Q71: All of the following items are identifiable

Q72: Lester's Fried Chick'n purchased its building 11