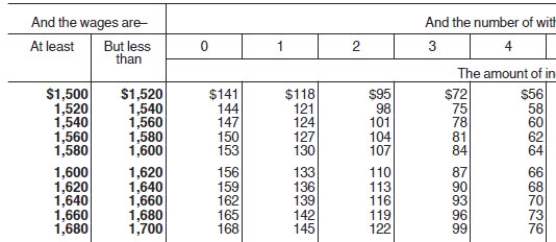

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,Federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the Federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points.)

Definitions:

Net Income Available

Net income available refers to the portion of a company's net income considered available for distribution or reinvestment, typically after accounting for dividends and other obligations.

Income Taxes

Taxes levied by a government directly on income, both earned (salaries, wages) and unearned (dividends, interest).

Preferred Dividends

Preferred dividends are regular dividend payments made to preferred shareholders before any dividends can be issued to common shareholders.

Dividends

Payments made by a corporation to its shareholder members. It can be issued in various forms, such as cash payment, stocks, or other forms.

Q5: In a charitable action,one firm is relieved

Q17: Donut Delite has total assets of $31,300,long-term

Q23: A payroll review process increases in complexity

Q28: Natalie is involuntarily terminated by a company

Q29: There are two open seats on the

Q45: World Exports has total assets of $938,280,a

Q49: Paycards represent a trend in employee compensation

Q69: Which of the following will not automatically

Q107: On September 1,2013,SI exchanged 2,000 shares of

Q146: Goods held on consignment for sale on