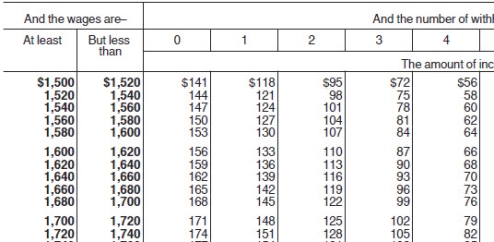

Ramani earned $1,698.50 during the most recent biweekly pay period.He contributes $100 to his 401(k) plan.He is married and claims 3 withholding allowances.Based on the following table,how much Federal income tax should be withheld from his pay?

Definitions:

Fair Value Option

The choice given to entities to report certain financial assets and liabilities at their fair value to measure change in their value.

Financial Instrument

An agreement resulting in a financial asset for one party and a financial obligation or equity security for another.

Receivables Recognition Irregularities

Irregularities or anomalies in recognizing receivables that may involve premature or improper revenue recognition, affecting the financial statements' accuracy.

Changes in Receivables

This refers to the variations in the amounts owed to a company by its customers over a specific period.

Q5: Which one of the following is most

Q8: Under the cost model,self-constructed assets may be

Q15: Which of the following is true about

Q17: KBJ has total assets of $613,000.There are

Q28: Adrienne worked 88 hours during a biweekly

Q31: The common stock of Sweet Treats has

Q33: Probably the least effective means of aligning

Q49: One advantage of the corporate form of

Q51: A retirement plan that allows employees to

Q74: Six months ago,Benders Gym repurchased $140,000 of