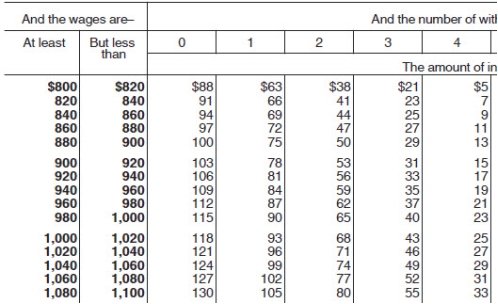

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k) plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table) ?

Definitions:

Personal Selling Process

A direct marketing approach that involves face-to-face interaction to sell a product or service.

Prospect

A potential customer or client who might be interested in a company's product or service.

Suggestive Selling

A sales technique where the salesperson suggests additional products or services to the customer, based on their initial purchase or interest.

Adaptive Selling Format

A flexible sales technique that allows customization of the sales approach based on the real-time needs and behaviors of the customer.

Q6: CZ purchased a new machine on June

Q13: The General Journal contains records of a

Q24: The payroll tax(es) for which an employer

Q33: Wyatt is a full-time exempt music engineer

Q34: Gamma Corp. is expected to pay the

Q64: What factor is not included in an

Q101: Plant assets may properly include:<br>A)property held for

Q102: A firm acquired used equipment on January

Q176: A consideration in determining the useful life

Q191: Training and advertising costs must be expensed