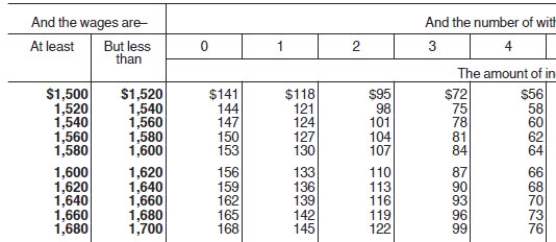

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,Federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the Federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points.)

Definitions:

Websites

Online platforms comprised of webpages, hosted on servers and accessible via the internet, used to present content or provide services to users.

Search Engines

Web-based tools that allow users to find information on the internet through keyword searches.

World Wide Web

A global system of interconnected documents and resources, accessible via the internet, using web browsers.

Users

Individuals or entities that utilize or operate something, commonly referring to people who engage with a product, service, or system.

Q2: On December 1,20XX,Riley Sanders invested $250,000 to

Q2: Disposable income is defined as:<br>A) An employee's

Q15: Goodwill should be reported on the balance

Q35: Payroll taxes for which the employer is

Q39: Joanna,a nonexempt employee,earns a salary of $38,950

Q43: With regards to salaried employees,employers must not:<br>A)

Q49: Paycards represent a trend in employee compensation

Q92: On a particular date,which of the following

Q94: Dixie's sales for the year were $1,678,000.Cost

Q178: Under both ASPE and IFRS,borrowing costs on