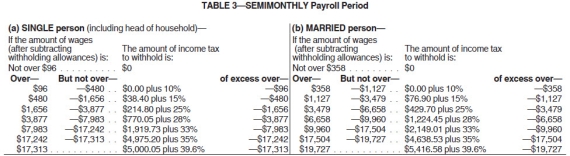

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the Federal income tax and the wage-bracket table for the state income tax.Do not round interim calculations,only round final answer to two decimal points.)

Definitions:

Rehabilitation Services

Rehabilitation services are healthcare services aimed at helping individuals regain, improve, or maintain their physical or cognitive functioning after injury or illness.

Respite Center

A facility or service that provides temporary relief for caregivers by taking care of their loved ones, often used in the context of chronic illness or disability.

Restorative Care Center

A facility focused on rehabilitation and recovery, aiming to restore a patient's health and functioning.

Discharge Planner

A healthcare professional who assists patients with the coordination of healthcare and community services in preparation for leaving a hospital or medical facility.

Q12: Trick's Costumes has 65 employees,who are

Q14: Jesse is a part-time nonexempt employee who

Q28: The IRS uses the _ to determine

Q47: What is the maximum average tax rate

Q53: SB traded in printing press A with

Q63: A particular stock sells for $43.20 share

Q69: Natalia is a full-time exempt employee who

Q99: The weighted-average inventory method rarely is used

Q133: During 2013,RB incurred the following expenditures (cash)

Q143: AB recently purchased an old building and