A company had poor internal control over its cash transactions.Facts about its cash position at June 30,2008,were as follows:

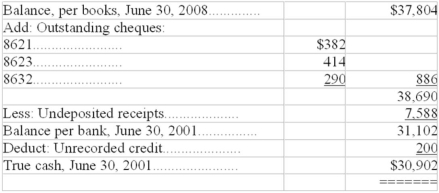

The cash account showed a balance of $37,804,which included undeposited receipts.A credit of $200 on the bank's records did not appear on the books of the company.The balance per the bank statement was $31,102.Outstanding cheques were: No.62 for $232,No.183 for $300,No.284 for $506,No.8621 for $382,No.8623 for $414,and No.8632 for $290.

The cashier removed all undeposited receipts in excess of $7,588 and prepared the following reconciliation:  Prepare a supporting schedule showing how much the cashier removed.Also,explain how the cashier attempted to conceal the theft.

Prepare a supporting schedule showing how much the cashier removed.Also,explain how the cashier attempted to conceal the theft.

Definitions:

Hedging

A risk management strategy used to offset potential losses or gains in an investment by taking an opposite position in a related asset.

Price Changes

Variations in the cost of goods and services over time, influenced by factors such as inflation, supply, and demand.

Rate Changes

Adjustments in interest or exchange rates that impact the financial markets and economic conditions.

Zero Sum Game

A situation in which the gain of one party is exactly matched by the loss of another party, indicating that no net wealth is created or destroyed in the transaction.

Q11: If the operating cycle of a business

Q35: Other comprehensive income includes unrealized gains on

Q36: MC exchanged one of its milling machines,which

Q37: If the current ratio for a company

Q49: Paycards represent a trend in employee compensation

Q57: A company had a petty cash

Q64: On September 16,2013,a corporation sold to a

Q96: Cash from customers equals sales plus the

Q108: Shoes-A-Lot Ltd.decided to adopt the retail method

Q142: Which one of the following would cause