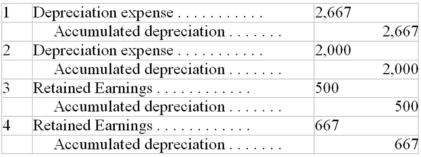

A company owns an operational asset acquired on January 1,2006 at a cost of $10,000.It had an estimated useful life of 5 years,no residual value,and was being depreciated on a straight-line basis.On December 31,2007,it was determined that the total useful life would be 4 years.The following adjusting entry (assuming no adjusting entries have been made) for the accounting year ended December 31,2007 should be made (rounded to the nearest dollar) :

Definitions:

Decisions

The choices made by individuals or organizations among two or more alternatives.

Return On Investment

A financial metric used to evaluate the efficiency of an investment or compare the efficiency of several investments, calculating the return relative to the investment's cost.

Income From Operations

Revenue generated from a company's regular business activities, excluding revenue from non-operating sources.

Invested Assets

Assets that have been allocated or invested in various forms such as stocks, bonds, or real estate, aiming for a financial return.

Q19: In the preparation of the Statement of

Q48: No revenue whatsoever from the performance of

Q50: E Company's bank statement and cash

Q56: On May 1,2005,a company purchased prepaid insurance,covering

Q59: If the estimate of bad debt expense

Q79: If income tax effects are ignored,accelerated amortization

Q116: Under IFRS,discounts or premiums on amortized cost

Q128: Under IFRS,depreciation expense and employee benefits expense

Q143: A Statement of Cash Flows using the

Q165: Cash paid to suppliers plus an increase