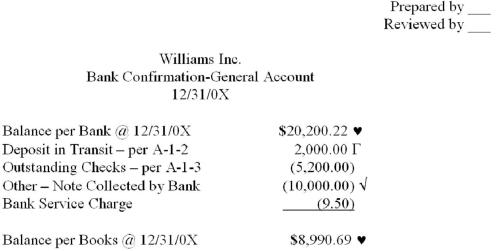

The following is an audit working paper prepared by an assistant on the Williams audit:

f Column footed.

f Column footed.

√ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/0X bank statement.This note is the Wilde note receivable that was recorded as a receipt by the client in the cash receipts journal on 1/3/0X.The receivable was appropriately credited and properly reflected in the January cash receipts journal.No adjustment needed as bank and books simply record this in different periods.

Г Agreed to 12/31/0X bank statement.

♥ Agreed to general ledger.

A - 1

Required: Prepare a list of review points as the preparer of this working.You may assume that any other working papers referred to are appropriate.You will receive credit for proper points you bring up and lose credit for improper ones and omissions.

Definitions:

Average Tax Rate

The ratio of the total amount of taxes paid to the total taxable income, indicating the portion of income that is paid in taxes.

Marginal Tax Rate

The tax rate that applies to the last dollar of the taxpayer's income, indicating the percentage of tax paid on any additional income earned.

Taxable Income

The portion of an individual or entity's income used as the basis to calculate how much the individual or entity owes in taxes.

Average Tax Rate

The proportion of total taxable income that individuals or corporations pay in taxes, calculated by dividing the total tax amount by the total income.

Q4: Which of the following is not correct

Q6: Which of the following statements about critical

Q11: Supply professionals should promote positive supplier relationships

Q19: As a part of the planning process,the

Q21: An investor is considering investing in one

Q26: Which of the following is least likely

Q26: An annual peer review is a requirement

Q28: Which of the following forms of advertising

Q45: Just-In-Time (JIT)inventory seeks to match factory output

Q82: The 1000 accounts receivable of Winco Company