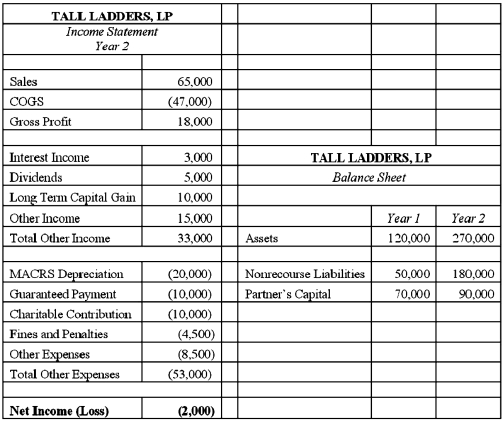

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Risky Stocks

Investments in the stock market that carry a high level of risk, typically due to volatility, lack of predictability, or the potential for substantial loss.

Market

A medium that allows buyers and sellers to exchange goods, services, or information.

Highly Competitive Market

A market structure characterized by a large number of sellers and buyers, leading to competitive pricing and minimal market power for individual firms.

Security Market Line

A representation in the capital asset pricing model (CAPM) that displays the relationship between the expected return of a security and its systemic risk.

Q10: A unitary return includes only companies included

Q14: Unrealized receivables include accounts receivable for which

Q25: Which of the following describes the correct

Q28: Which of the following is not a

Q28: If a corporation's cash charitable contributions exceed

Q30: Delivery of tangible personal property through common

Q88: Shea is a 100% owner of Mets

Q98: Tammy owns 60 percent of the stock

Q103: Net capital loss carryovers but not carrybacks

Q108: Clampett, Inc. converted to an S corporation