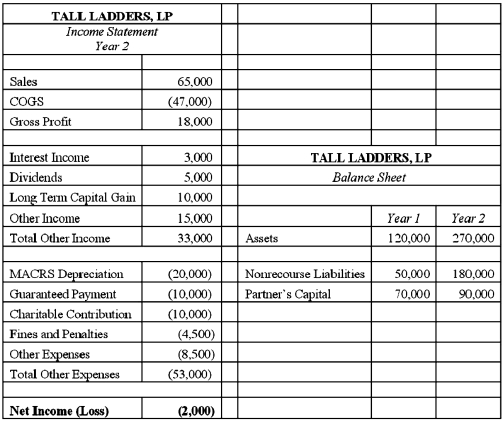

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Sponges

Simple aquatic invertebrates known for their porous bodies through which water flows, extracting nutrients and oxygen.

Cubozoans

Members of the class Cubozoa, a group of highly venomous box jellyfish known for their cube-shaped medusae and potent stings.

Nemerteans

The phylum of animals commonly known as ribbon worms; each has a proboscis (tubular feeding organ) for capturing prey.

Proboscis

A long projection originating from an animal's head, particularly in insects, that serves for either eating or detecting stimuli.

Q1: Half Moon Corporation made a distribution of

Q11: S corporation shareholders are legally responsible for

Q33: In each of the independent scenarios below,

Q34: Which of the following statements best describes

Q50: Cardinal Corporation reported pretax book income of

Q58: Under a U.S. treaty, what must a

Q68: A corporation with a minimum tax credit

Q79: Which of the following statements regarding hot

Q95: A U.S. corporation reports its foreign tax

Q96: Which of the following individuals is not