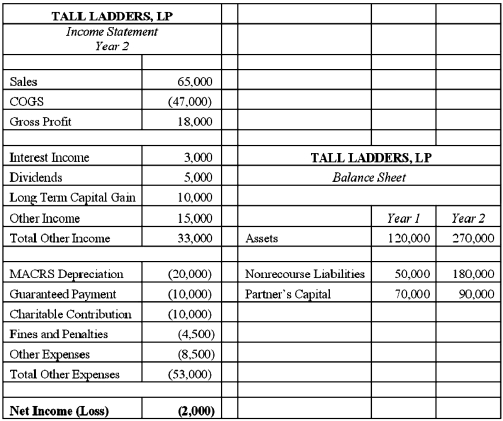

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Job Seekers

Individuals actively looking for employment opportunities.

Recruiters

Professionals responsible for identifying, attracting, and hiring talent for job positions within organizations.

Human Capital

The collective skills, knowledge, and abilities of an organization's employees considered as an economic value.

Workforce Participants

are individuals who are actively engaged in the workforce, either as employees, self-employed individuals, or volunteers, contributing to the economic activity.

Q24: Houghton Company reports negative current E&P of

Q30: When determining a partner's gain on sale

Q32: Volos Company (a calendar-year corporation) began operations

Q61: An S corporation may be voluntarily or

Q68: Partnerships can use special allocations to shift

Q68: Gordon operates the Tennis Pro Shop in

Q77: A valuation allowance is recorded against a

Q80: Bobby T (75% owner) would like to

Q96: A partner that receives cash in an

Q97: Jason is a 25% partner in the