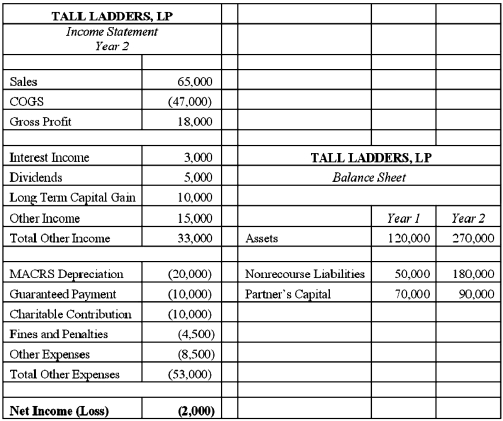

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Ion Channels

Channels for the passage of ions through a membrane; formed by specific membrane proteins.

Plasma Membranes

The plasma membrane is the biological membrane that separates the interior of all cells from the outside environment, controlling the movement of substances in and out of cells.

Ras Proteins

A family of proteins involved in transmitting signals within cells, playing key roles in the regulation of cell division, growth, and differentiation.

G Proteins

A family of proteins that act as molecular switches inside cells, involved in transmitting signals from stimuli outside the cell to its interior.

Q10: Which of the following items are subject

Q20: Partnerships must maintain their capital accounts according

Q21: Gordon operates the Tennis Pro Shop in

Q25: El Toro Corporation declared a common stock

Q26: Jackson is the sole owner of JJJ

Q61: A calendar-year corporation has negative current E&P

Q61: A section 338 transaction is a stock

Q78: Compensation recharacterized by the IRS as a

Q84: Elk Company reports negative current E&P of

Q89: Actual or deemed cash distributions in excess