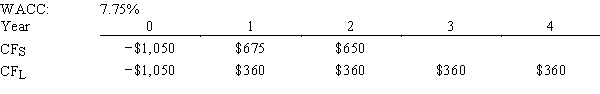

Carolina Company is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and are not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

Definitions:

Short Run

A time period in economics during which at least one input is fixed and cannot be changed by the business.

Monopolistically Competitive

Refers to a market structure where many firms sell products that are similar but not identical, allowing for some degree of market power in setting prices.

Average Total Cost

Average total cost is the total cost of production divided by the number of units produced, encompassing both fixed and variable costs.

Per-Unit Profit

The profit earned on each unit of a product sold, calculated by subtracting the per-unit cost from the selling price per unit.

Q4: Which of the following statements is CORRECT?<br>A)Most

Q5: Which of the following is NOT normally

Q7: A warrant is an option,and as such

Q22: For the newly industrialized countries of East

Q23: Heavy use of off-balance sheet lease financing

Q28: Which of the following factors would be

Q32: Spot-Free Car Wash is considering a

Q59: Diversification will normally reduce the riskiness of

Q71: Refer to Exhibit 21.1.What's the difference in

Q86: If the expected dividend growth rate is