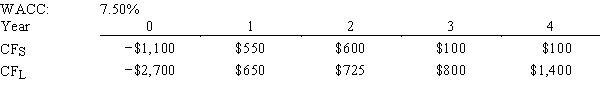

Current Design Co.is considering two mutually exclusive,equally risky,and not repeatable projects,S and L.Their cash flows are shown below.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e.,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

Toxicity

The degree to which a substance can cause harm to an organism, ranging from mild irritation to lethal effects.

Clinical Equipoise

The ethical principle in clinical research that requires genuine uncertainty within the expert medical community regarding the comparative therapeutic merits of each arm in a trial.

Treatment Options

Various medical interventions available for diagnosing, managing, or curing diseases or injuries.

Speciesism

The assumption of human superiority leading to the exploitation of animals, based on the belief that all and only human beings have intrinsic value.

Q1: Operating leases help to shift the risk

Q1: The "preferred" feature of preferred stock means

Q4: You were recently hired by Garrett Design,Inc.to

Q5: Suppose a company issued 30-year bonds 4

Q13: Any change in its beta is likely

Q20: Going public establishes a market value for

Q31: Refer to Exhibit 17.3.What is the yield

Q119: Krackle Korn Inc.had credit sales of $3,500,000

Q127: Which of the following statements concerning the

Q192: Studies by the World Bank and others