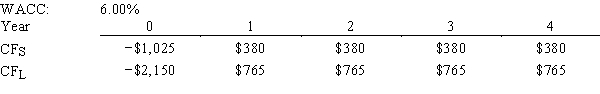

Murray Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise Murray on the best procedure.If the wrong decision criterion is used,how much potential value would Murray lose?

Definitions:

Total Logistics Cost

The complete sum of all expenses associated with the planning, implementing, and controlling of the movement and storage of goods from point of origin to point of consumption.

Decision Areas

Specific domains or aspects within an organization or project that require decision-making.

Flow of Goods

The movement of products from the place of production to the end consumer, including all the stages in between, such as warehousing and transportation.

Customer Service Factors

Elements that influence the quality of support and service provided to customers, including responsiveness, empathy, reliability, and communication.

Q4: If a stock's market price exceeds its

Q6: Which of the following statements about listing

Q13: The average accounts receivable balance is a

Q15: Myron Gordon and John Lintner believe that

Q20: Refer to Exhibit 16.3.Now assume that BB

Q27: Which of the following statements is CORRECT?<br>A)Other

Q38: Which of the following should not influence

Q54: Export promotion provided infant industries with a

Q145: Which of the following statements is CORRECT?<br>A)Diversifiable

Q192: Studies by the World Bank and others