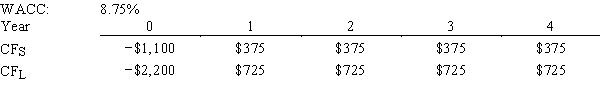

Silverman Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Ideological Confrontation

A conflict or clash between differing belief systems, values, or ideologies.

United States

A country in North America consisting of 50 states, a federal district, and several territories, known for its significant influence on global affairs.

Soviet Union

A former federal socialist state in Eastern Europe and Asia, existing from 1922 to 1991, officially known as the Union of Soviet Socialist Republics (USSR), which was composed of multiple republics.

Shiite Arabs

Members of the Shia Islam branch primarily located in the Middle East, with significant communities among Arab populations.

Q2: Harvey's Industrial Plumbing Supply's target capital structure

Q4: More than half of the labor force

Q4: Which of the following statements is CORRECT?<br>A)Although

Q6: The component costs of capital are market-determined

Q8: Real options are most valuable when the

Q10: In the MM extension with growth,the appropriate

Q16: Puckett Inc.risk-adjusts its WACC to account for

Q23: Heavy use of off-balance sheet lease financing

Q59: You have just landed an internship

Q74: Firms raise capital at the total corporate