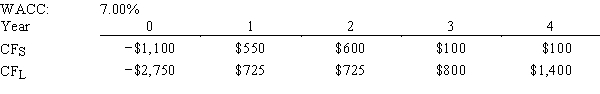

Langton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone.In other words,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Estimating

The process of approximating the time, cost, and resources needed to complete a project.

FICA-Social Security

A U.S. government program funded by payroll taxes under the Federal Insurance Contributions Act (FICA) that provides retirement benefits, disability income, and survivor benefits.

Withheld

Typically refers to portions of an employee’s earnings that are not paid directly to the employee but instead held back for taxes, retirement contributions, or other purposes.

Matched By Employer

Contributions made by an employer towards an employee's benefit plan, such as a 401(k), that are equal to the contributions made by the employee.

Q10: If investors are risk averse and hold

Q19: Even if the correlation between the returns

Q26: Although short-term interest rates have historically averaged

Q27: Cartwright Communications is considering making a change

Q47: Century Roofing is thinking of opening

Q73: On average,a firm collects checks totaling $250,000

Q89: If expectations for long-term inflation rose,but the

Q97: Stock X has a beta of 0.6,while

Q103: Stock X has a beta of 0.7

Q120: Historically,more than _ of the funds distributed