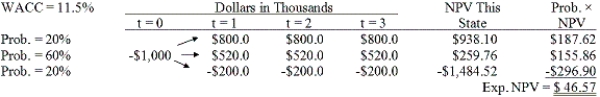

Brandt Enterprises is considering a new project that has a cost of $1,000,000,and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

Definitions:

Trade Negotiations

Formal discussions and agreements between countries focused on the terms of trade, including tariffs, access to markets, and other related policies.

GATT

The General Agreement on Tariffs and Trade, an international treaty designed to promote international trade by reducing or eliminating trade barriers such as tariffs.

North American

Pertaining to or relating to the continent that comprises Canada, the United States, Mexico, and the countries of Central America.

Trade Agreement

A contract between nations regarding their trade relationships, including terms on tariffs, trade restrictions, and other aspects of international trade.

Q6: Assume a project has normal cash flows.All

Q12: According to MM,in a world without taxes

Q12: Refer to Exhibit 14.2.Assuming that all cash

Q23: Any cash flows that can be classified

Q30: An all-equity firm with 200,000 shares outstanding,Antwerther

Q33: Which of the following rules is CORRECT

Q42: Other things held constant,an increase in the

Q44: McLeod Inc.is considering an investment that has

Q59: Which of the following statements is CORRECT,holding

Q84: Stock A's beta is 1.7 and Stock