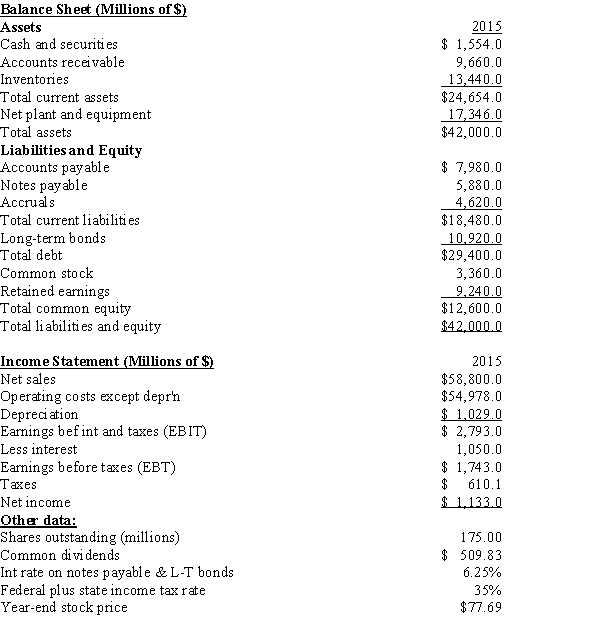

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 7.1.What is the firm's current ratio?

Definitions:

Present Value Calculation

A financial process that determines the current worth of a future cash flow, stream of cash flows, or an investment, based on a specific discount rate.

Declining-Balance Depreciation

Declining-Balance Depreciation is an accelerated depreciation method that calculates higher depreciation expenses in the earlier years of an asset's life, decreasing over time.

Lease Liability

A financial obligation representing the present value of all future lease payments a lessee is committed to make under lease agreements.

Invests

The act of allocating resources, usually money or capital, in something to earn financial returns or gain profitable outcomes.

Q2: Your aunt wants to retire and has

Q13: Suppose it takes 1.82 U.S.dollars today to

Q15: One of the main reasons why foreign

Q20: Which of the following statements is CORRECT?<br>A)The

Q40: If an investor can obtain more of

Q42: From an investor's perspective,a firm's preferred stock

Q42: Refer to Exhibit 7.1.What is the firm's

Q77: Which of the following events would make

Q121: Thornton Universal Sales' cost of goods sold

Q131: You plan to borrow $35,000 at a