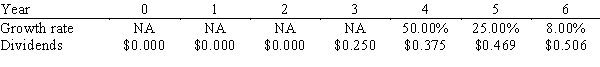

Sawchuck Consulting has been profitable for the last 5 years,but it has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value?

Definitions:

Q9: Braddock Construction Co.'s stock is trading at

Q19: EP Enterprises has the following income

Q22: Holland Auto Parts is considering a merger

Q34: Ranger Inc.would like to issue new 20-year

Q40: Hunter Manufacturing Inc.'s December 31,2014 balance sheet

Q56: If the required rate of return on

Q85: Ellen now has $125.How much would she

Q91: The YTMs of three $1,000 face value

Q98: A firm wants to strengthen its financial

Q118: Your cousin will sell you his coffee