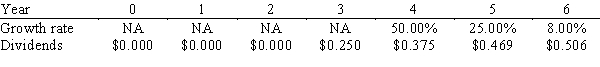

Sawchuck Consulting has been profitable for the last 5 years,but it has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value?

Definitions:

Actual Total Labour Cost

The real amount spent on wages and benefits for employees involved in the production process during a specific period.

Standard Labour Rate

The pre-established rate per hour that a company expects to pay for direct labor.

Actual Units

The real quantity of items produced, sold, or consumed, as opposed to planned or theoretical quantities.

Variable Overhead Spending Variance

This is the difference between the actual variable overheads incurred and what was expected or budgeted, based on the actual level of production activity.

Q8: If the range of feasibility indicates that

Q8: Fold back this decision tree.Clearly state the

Q14: Sensitivity analysis is often referred to as<br>A)feasibility

Q29: In 1985,a given Japanese imported automobile sold

Q31: Southwestern Bank offers to lend you $50,000

Q45: If P(A|B)= .4 and P(B)= .6,then

Q87: Which of the following is most likely

Q162: A U.S.Treasury bond will pay a lump

Q164: On January 1,2016,your sister's pet supplies business

Q174: A zero coupon bond is a bond