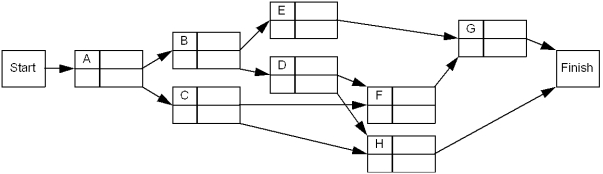

For the project represented below,determine the earliest and latest start and finish times for each activity as well as the expected overall completion time.

Definitions:

Challenging Yet Believable

Tasks or goals that are difficult and stretch abilities but still within the realm of achievability.

Provokes Skepticism

Something that induces doubt or a questioning attitude, often due to inconsistencies or lack of evidence.

Successful Vision

A clear and compelling future scenario or goal that a person or organization strives to achieve, often inspiring and guiding strategic planning.

Vision

The capacity to envision a clear and compelling future state that inspires and motivates people to work together towards its realization.

Q12: In situations where you need to compare

Q15: Which of the following is an example

Q15: Because a bad-bank bank has a difficult

Q17: The constraint x<sub>1</sub> + x<sub>2</sub> + x<sub>3</sub>

Q28: Henry,a persistent salesman,calls North's Hardware Store once

Q30: It is advantageous for the residential mortgage

Q35: Arcs in a transshipment problem<br>A)must connect every

Q48: A businessman is considering opening a

Q82: The traditional interbank loan sale market has

Q87: The credit risk on an interest rate