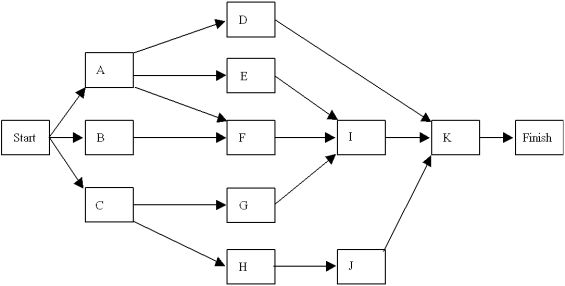

Given the following network with activities and times estimated in days,

a.What are the critical path activities?

b.What is the expected time to complete the project?

c.What is the probability the project will take more than 28 days to complete?

Definitions:

Bulldozer

A heavy, tractor-like vehicle with a large, metal plate used to push large quantities of soil, sand, rubble, or other such material during construction or conversion work.

Capital Loss Deduction

A tax deduction for losses incurred on the sale of an asset held for investment, allowing for the offset of capital gains or regular income up to certain limits.

Business Property

Assets and property owned by a business used in the operation and function of the business, including real estate, equipment, and intellectual property.

Casualty

A sudden, unexpected, or unusual event that causes damage or loss, often used in reference to natural disasters for tax deduction purposes.

Q9: Let x<sub>1</sub> ,x<sub>2</sub> ,and x<sub>3</sub> be 0

Q12: FNMA securitizes conventional mortgage loans as well

Q14: How are both analysts and managers involved

Q14: If a transportation problem has four origins

Q19: Revenue management methodology was originally developed for

Q21: Describe a time series plot and discuss

Q36: Trials of a simulation show what would

Q46: The growth of the commercial paper market

Q51: Which of the following is not accomplished

Q109: If the entire mortgage pool is repaid