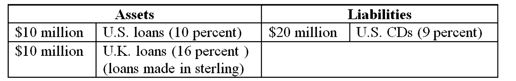

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the exchange rate had fallen from $1.60/≤1 at the beginning of the year to $1.50/≤1 at the end of the year, the weighted return on the FI's asset portfolio would be

Definitions:

Fast and Effortless

Activities or processes that are completed quickly and with minimal mental or physical exertion.

Mind-Body Problem

The difficulty in understanding how the mind and body influence each other—so that physical events can cause mental events, and so that mental events can cause physical ones.

Descartes

A French philosopher, mathematician, and scientist whose work laid the foundation for much of modern philosophy, especially in regards to dualism and the relationship between the mind and body.

Separate

To cause to move or be apart; to divide.

Q1: The liquidity coverage ratio (LCR) and net

Q2: The greater is convexity, the more insurance

Q26: Funds transferred on Fedwire are settled at

Q40: What is the most important factor determining

Q41: The Volker Rule is intended to reduce

Q49: To be an affiliate of a holding

Q52: In the BIS standardized framework model, the

Q72: A key assumption of Macaulay duration is

Q81: Losses among FIs that actively traded mortgage-backed

Q101: When the Fed finds it necessary to