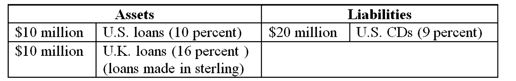

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-What amount, in sterling, will the FI have to repatriate back to the U.S. after one year if the exchange rate remains constant at $1.60 to ≤1.

Definitions:

Simple Interest

Interest earned or paid on the original principal only of a deposit or loan, without compounding.

Loan Repaid

The act of paying back borrowed money to the lender.

Borrowed

The state of having taken something on loan, often with the obligation to return it or repay an equivalent amount.

Annual Rate

The interest rate for a whole year, as opposed to just a monthly or daily rate.

Q17: Off-balance sheet positions are risky because they

Q26: Funds transferred on Fedwire are settled at

Q30: In the statistical modeling of the country

Q41: The economic insolvency of many thrift institutions

Q52: In the BIS standardized framework model, the

Q74: Credit rationing by an FI<br>A)involves restricting the

Q78: The primary difficulty in arranging a syndicated

Q92: Residential mortgages are the smallest component of

Q93: The gap ratio is<br>A).015.<br>B)-.015.<br>C).025.<br>D)-.144.<br>E).154.

Q102: Which of the following statements does NOT