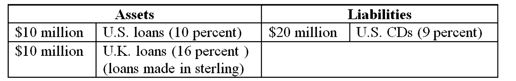

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-The weighted return on the bank's portfolio of investments would be

Definitions:

Organizational Culture

The shared values, beliefs, norms, and practices that shape the social and psychological environment of an organization, influencing its members' behavior and attitudes.

External Behavior

Actions or reactions exhibited by an individual that are observable by others, reflecting a response to the surrounding environment.

Workforce

The total number of a country's or organization's employed individuals, including both full-time and part-time workers.

Organizational Culture Inventory (OCI)

A survey instrument designed to assess the culture of an organization by measuring the behaviors and norms that are encouraged or penalized.

Q9: How would you characterize the FI's risk

Q17: As securitization of assets continues to expand,

Q22: Which of the following FX trading activities

Q23: The foreign exchange market in Tokyo is

Q28: Banks in the countries that are members

Q29: Commercial bank call reports are provided by

Q35: FIs are competing directly with loan commitments,

Q47: If two countries are identical in all

Q50: The maturity gap model estimates the difference

Q86: What does Gotbucks Bank's 91-day gap positions