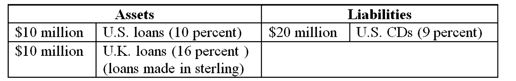

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the exchange rate had fallen from $1.60/≤1 at the beginning of the year to $1.50/≤1 at the end of the year, the weighted return on the FI's asset portfolio would be

Definitions:

Correlation Analysis

The study of how variables are related and the measurement of the strength and direction of this relationship.

Linear Relationship

A type of relationship between two variables where a change in one variable is associated with a proportional change in the other variable.

Independent Variables

Variables in an experiment or model that are manipulated or varied to observe their effects on dependent variables.

Regression Analysis

A statistical method used to examine the relationship between a dependent variable and one or more independent variables.

Q5: If interest rates decrease 50 basis points

Q6: What is a fire-sale price?<br>A)Market value of

Q8: According to purchasing power parity (PPP), foreign

Q35: Demand deposits pose a liquidity risk for

Q38: Sovereign country risk is largely independent of

Q44: A lending decision to a firm in

Q48: To a U.S. trader of foreign currencies,

Q66: The portfolio of a bank that contains

Q74: As of March 2012, U.S. banks were

Q103: There is a positive relationship between the