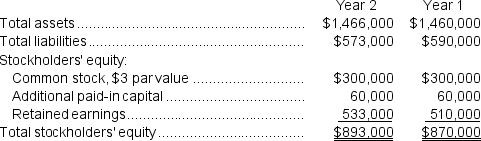

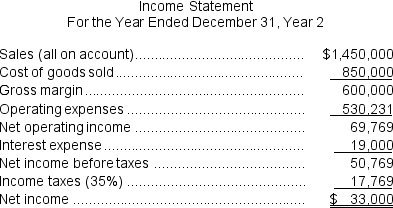

Jaquez Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $10,000.The market price of common stock at the end of Year 2 was $5.45 per share.

Dividends on common stock during Year 2 totaled $10,000.The market price of common stock at the end of Year 2 was $5.45 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

h.What is the company's earnings per share for Year 2?

i.What is the company's price-earnings ratio for Year 2?

j.What is the company's dividend payout ratio for Year 2?

k.What is the company's dividend yield ratio for Year 2?

l.What is the company's book value per share at the end of Year 2?

Definitions:

HRM Systems

Software platforms that support the functions of human resource management, including recruitment, payroll, performance management, and employee development.

Succession Management

A systematic process of identifying and preparing suitable employees through mentoring, training, and job rotation, to replace key positions within an organization in the future.

High-potential Employees

Employees identified within an organization as having the ability, aspiration, and engagement to rise to and succeed in more senior positions.

Leadership Talent

The skills and abilities possessed by individuals which enable them to lead others effectively and drive organizational success.

Q4: The required rate of return is the

Q17: The company's net cash provided by (used

Q17: Commercial banks have had limited power to

Q26: Commercial banks and finance companies have traditionally

Q32: Respass Corporation has provided the following data

Q46: A project requires an initial investment of

Q51: The income tax expense in year 3

Q142: The company's book value per share at

Q142: Depreciation expense is not included in the

Q178: (Ignore income taxes in this problem.)Jim Bingham