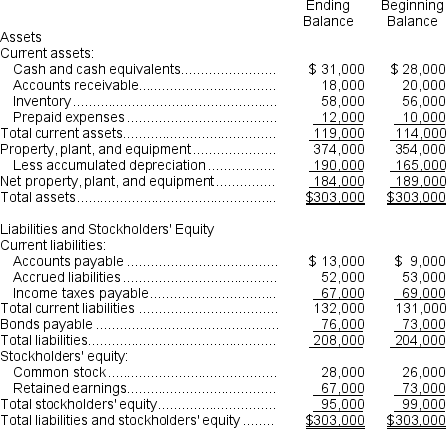

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Actual Call Price

The actual price at which a callable bond or other financial instrument can be redeemed by the issuer before its maturity date.

Intrinsic Value

The inherent, true value of an asset, investment, or company, based on its fundamental characteristics and financial health.

Binomial Value

A value derived from the binomial options pricing model, representing the potential future value of an option based on different paths the underlying asset's price can take.

Intrinsic Value

The perceived or calculated value of a company, currency, or asset based on its true fundamental value, excluding market fluctuations.

Q24: An FI is exposed to liquidity risk

Q28: (Ignore income taxes in this problem.)The management

Q42: Infante Corporation has provided the following information

Q53: An increase in the expected salvage value

Q54: When computing the return on equity,retained earnings

Q79: Which of the following would be added

Q134: The term joint cost is used to

Q135: A capital budgeting project's incremental net income

Q138: When a company is involved in more

Q153: (Ignore income taxes in this problem.)The management