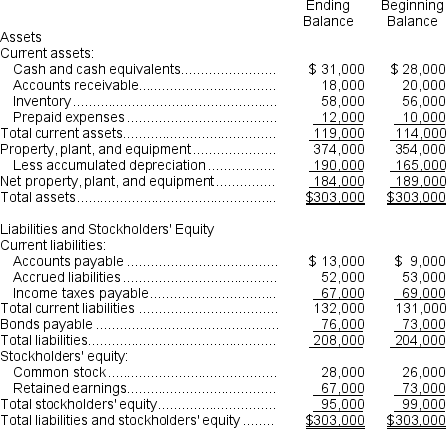

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Uncollectible Accounts

Accounts receivable that are considered unlikely to be collected and are therefore written off as a loss.

Direct Write-off Method

A method used in accounting to write off bad debts when they are determined to be uncollectible, impacting accounts receivable and expense accounts directly.

Recovery of Bad Debt

The process of collecting funds previously written off as uncollectible, generally resulting in an income statement gain the period it's recovered.

Percent of Sales Method

A financial forecasting approach that estimates future financial statements' items as a percentage of projected sales.

Q20: Marbry Corporation's balance sheet and income statement

Q39: Investment companies are successful in attracting business

Q66: If the internal rate of return is

Q73: Which of the following items would not

Q81: The net present value of the entire

Q83: The company's price-earnings ratio is closest to:<br>A)

Q97: The income tax expense in year 2

Q111: The total cash flow net of income

Q134: The term joint cost is used to

Q269: For Year 2,Etzkorn Corporation's sales were $1,480,000,its