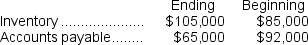

Last year Marton Corporation reported a cost of goods sold of $720,000 on its income statement.The following additional data were taken from the company's comparative balance sheet for the year: The company uses the direct method to determine the net cash provided by (used in) operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be:

The company uses the direct method to determine the net cash provided by (used in) operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be:

Definitions:

Computer Fraud and Abuse Act

A U.S. law that criminalizes unauthorized access to computers and networks.

Confidential Client Lists

Lists that contain private information about clients, protected to maintain confidentiality and competitive advantage.

Financial Information

Data regarding the economic activities and condition of an individual or organization, including income, expenses, assets, and liabilities.

Responsible Corporate Officer Doctrine

The Responsible Corporate Officer Doctrine is a principle that holds corporate executives and officers liable for the illegal actions of the corporation, even without direct involvement, if they had power to prevent the misconduct.

Q28: Paying taxes to governmental bodies is considered

Q46: Last year Anderson Corporation reported a cost

Q73: The total cash flow net of income

Q84: Schweinsberg Corporation is considering a capital budgeting

Q94: What distinguishes financial intermediaries from industrial firms?<br>A)FI

Q130: (Ignore income taxes in this problem)The management

Q147: Wood Carving Corporation manufactures three products.Because of

Q148: Padmore Corporation has provided the following information

Q185: Narstad Corporation's debt-to-equity ratio at the end

Q262: If the acid-test ratio is less than