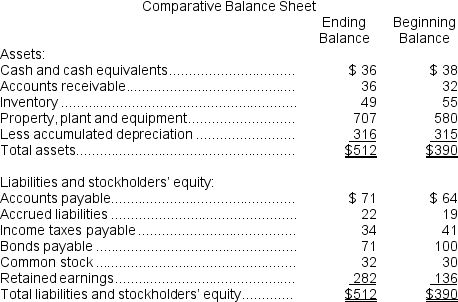

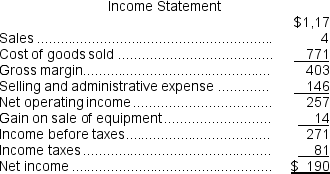

(Appendix 14A) Kilduff Corporation's balance sheet and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5. The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5. The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in) investing activities for the year was:

Definitions:

Illegality of Object

Refers to a principle in contract law that prohibits the enforcement of agreements that involve an illegal purpose or object.

Rescission

The legal act of cancelling or annulling a contract, returning all involved parties to their state prior to the contract's formation.

Statutory Assignment

The transfer of rights or benefits from one party to another in accordance with statutory provisions.

Assignee

An individual or entity to which rights or interests have been transferred, typically in the context of contracts or other legal agreements.

Q9: Data from Dalpiaz Corporation's most recent balance

Q11: (Ignore income taxes in this problem.)Trovato Corporation

Q41: Last year Burch Corporation's cash account decreased

Q53: Mccrohan Corporation is considering a capital budgeting

Q56: Safety and soundness regulations include all of

Q75: Accepting a special order will improve overall

Q122: Money received from issuing bonds payable would

Q138: The payback method is most appropriate for

Q184: The inventory turnover for Year 2 is

Q186: Maraby Corporation's inventory turnover for Year 2