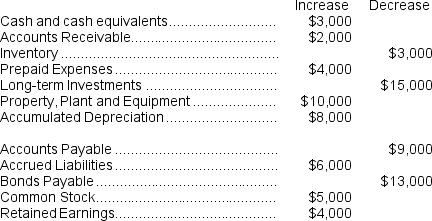

(Appendix 14A) The change in each of Kendall Corporation's balance sheet accounts last year follows:

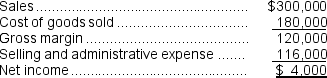

Kendall Corporation's income statement for the year was:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,the cost of goods sold adjusted to a cash basis would be:

Definitions:

Fair Value Method

An accounting approach that estimates the price of an asset or liability based on current market conditions.

Bonds

Long-term debt securities issued by corporations, municipalities, or governments that pay periodic interest payments to investors.

Fair Value

A measure of the estimated price at which an asset could be bought or sold or a liability settled, under current market conditions.

Passive Investments

Investments in which the investor does not actively manage or influence the operation of the asset, such as stocks or mutual funds.

Q9: Kaze Corporation's cash and cash equivalents consist

Q71: Faustina Chemical Corporation manufactures three chemicals (TX14,NJ35,and

Q74: The company's earnings per share is closest

Q86: Feiler Corporation has total current assets of

Q109: The present value of the annual cost

Q125: Petro Corporation has provided the following information

Q132: What is Stone's net cash provided by

Q133: The company's return on total assets for

Q135: A capital budgeting project's incremental net income

Q186: Hamby Corporation is preparing a bid for