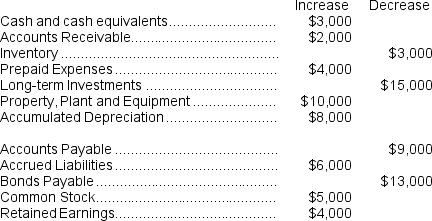

(Appendix 14A) The change in each of Kendall Corporation's balance sheet accounts last year follows:

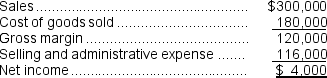

Kendall Corporation's income statement for the year was:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided by (used in) investing activities would be:

Definitions:

Outstanding Voting Shares

The total number of shares of a corporation that are held by shareholders and eligible to vote at shareholder meetings.

Fair Value

The market value of an asset or liability, based on the current price at which it can be sold or settled.

Unrealized Loss

A loss that results from holding an asset that has decreased in value, but the asset has not yet been sold.

Deferred Tax Asset

This asset arises when a company pays more taxes to the government than it currently owes in its financial statements, to be used for future tax relief.

Q50: Depository institutions (DIs) play an important role

Q52: Skowyra Corporation has provided the following information

Q69: Thunder Corporation's balance sheet and income statement

Q70: The net present value of the entire

Q76: The simple rate of return is computed

Q112: The income tax expense in year 2

Q140: Wegener Corporation's most recent balance sheet and

Q226: Linzey Corporation has provided the following data:<br><img

Q236: Lindboe Corporation has provided the following financial

Q275: Two-Rivers Inc.(TRI)manufactures a variety of consumer products.The