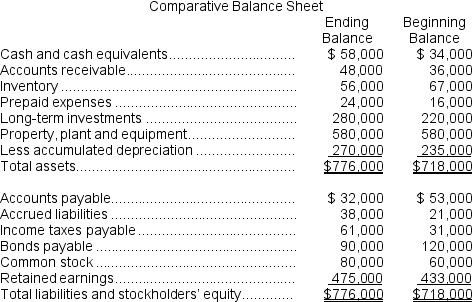

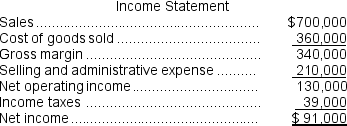

(Appendix 14A) Van Beeber Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

Definitions:

Discontinues a Segment

The process of stopping operations, production, or sale of a particular division or segment within a larger business.

Continuing Operations

Parts of a business expected to continue for the foreseeable future, excluding any discontinued operations.

Sarbanes-Oxley Act

The Sarbanes-Oxley Act is a U.S. law enacted in 2002 to protect investors from potential fraudulent activities by corporations, improving financial disclosures and preventing accounting fraud.

Auditor's Report

A formal opinion or disclaimer, issued by an independent external auditor as a result of an audit or evaluation of a firm's financial statements.

Q5: The simple rate of return on the

Q35: Paine Corporation processes sugar beets in batches

Q70: Which of the following is correct regarding

Q75: Income taxes have no effect on whether

Q86: The net present value of the entire

Q90: Product U23N has been considered a drag

Q129: The dividend payout ratio is equal to

Q129: (Ignore income taxes in this problem.)The following

Q147: (Ignore income taxes in this problem.)Wary Corporation

Q148: The company's operating cycle for Year 2