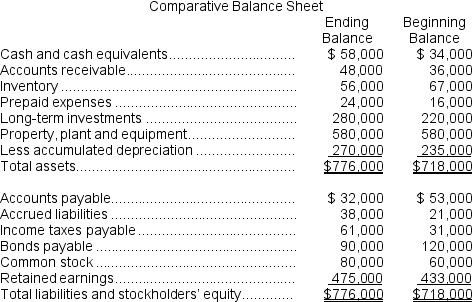

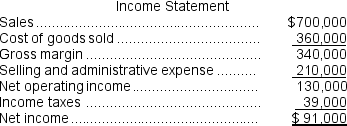

(Appendix 14A) Van Beeber Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

Definitions:

Negligence

The absence of the caution a typically careful individual would use in similar circumstances.

Grossly Negligent

Refers to a severe lack of care or action that significantly breaches the duty of care owed to another, resulting in substantial harm or risk.

Financial Irregularities

Unusual or improper financial transactions that may indicate mismanagement, fraud, or violations of regulations.

Contradictory Evidence

Information or data that directly opposes or disputes the claims or findings presented in a specific context.

Q9: Kaze Corporation's cash and cash equivalents consist

Q15: Which of the following would be classified

Q59: Gnas Corporation's total current assets are $210,000,its

Q83: Klutz Dance Studio had net income of

Q125: Petro Corporation has provided the following information

Q147: Wood Carving Corporation manufactures three products.Because of

Q165: The company's debt-to-equity ratio at the end

Q178: Acquiring land by taking out a long-term

Q208: Steinkraus Corporation has provided the following data:<br>

Q270: The company's earnings per share for Year